FX AI Analyst

Moving money with market insights

Introduction

Context Xflow helps businesses move money across borders. Our users typically receive payments in USD and cash out in INR. We offered great exchange rates, but there was a catch: the market changes every day. A rate that's good on Monday could be terrible on Wednesday — and our users had no way to navigate this volatility. This case study shows how we gave them that control.

Role

Lead Designer

Team

4 people

Duration

1.5 months

Impact

- Processed USD 4+ million in transactions using this product in just 6 months. It became our key differentiator.

- Users earned an extra ₹10+ lakh compared to converting at random times — purely by timing the market better with our tools.

The Problem

For businesses dealing with international payments, currency fluctuation is a constant source of anxiety. A favorable rate can mean significant savings, while a sudden drop can erode margins instantly.

Users were often glued to their screens, manually tracking rates and trying to guess the 'right' moment to transfer. This reactive approach was stressful, inefficient, and often led to missed opportunities. They needed a way to see into the future, or at least, to make informed decisions without the constant monitoring.

Opportunity

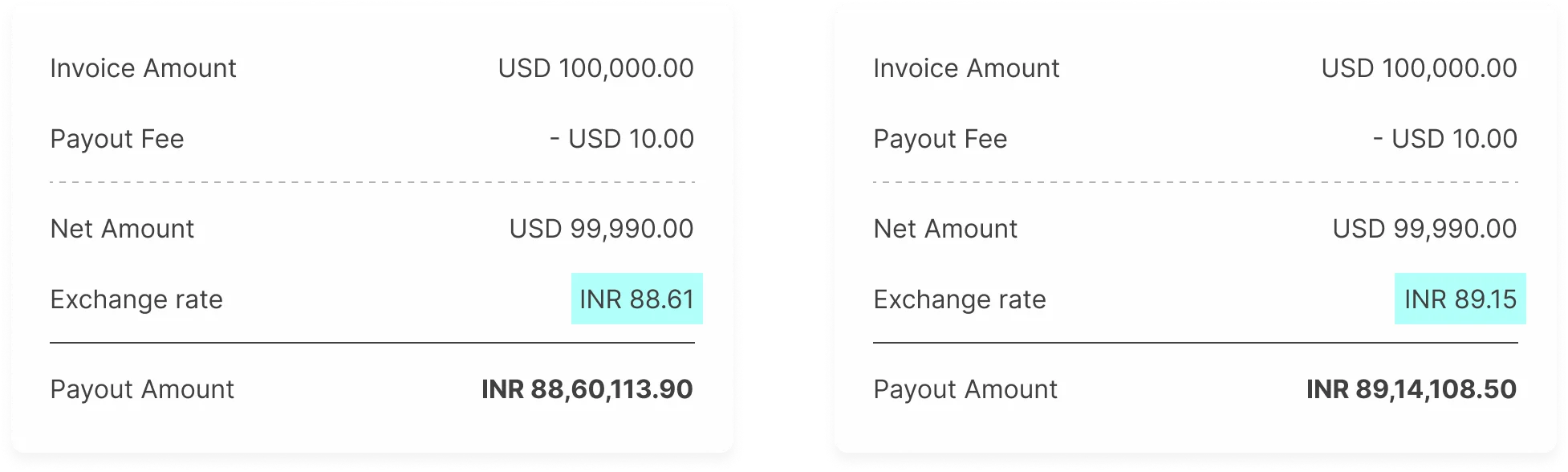

Users crave predictability, but FX markets are volatile. A small shift in the exchange rate can mean losing tens of thousands of rupees. Here's how much impact a half-rupee difference can make:

A difference of just half a rupee in the FX rate leads to tens of thousands of rupees in payout difference

Our Approach We couldn't control the market, but we could help our users navigate it. By giving them market insights and smart tools, we enabled them to time their transactions for better rates. We built two products:

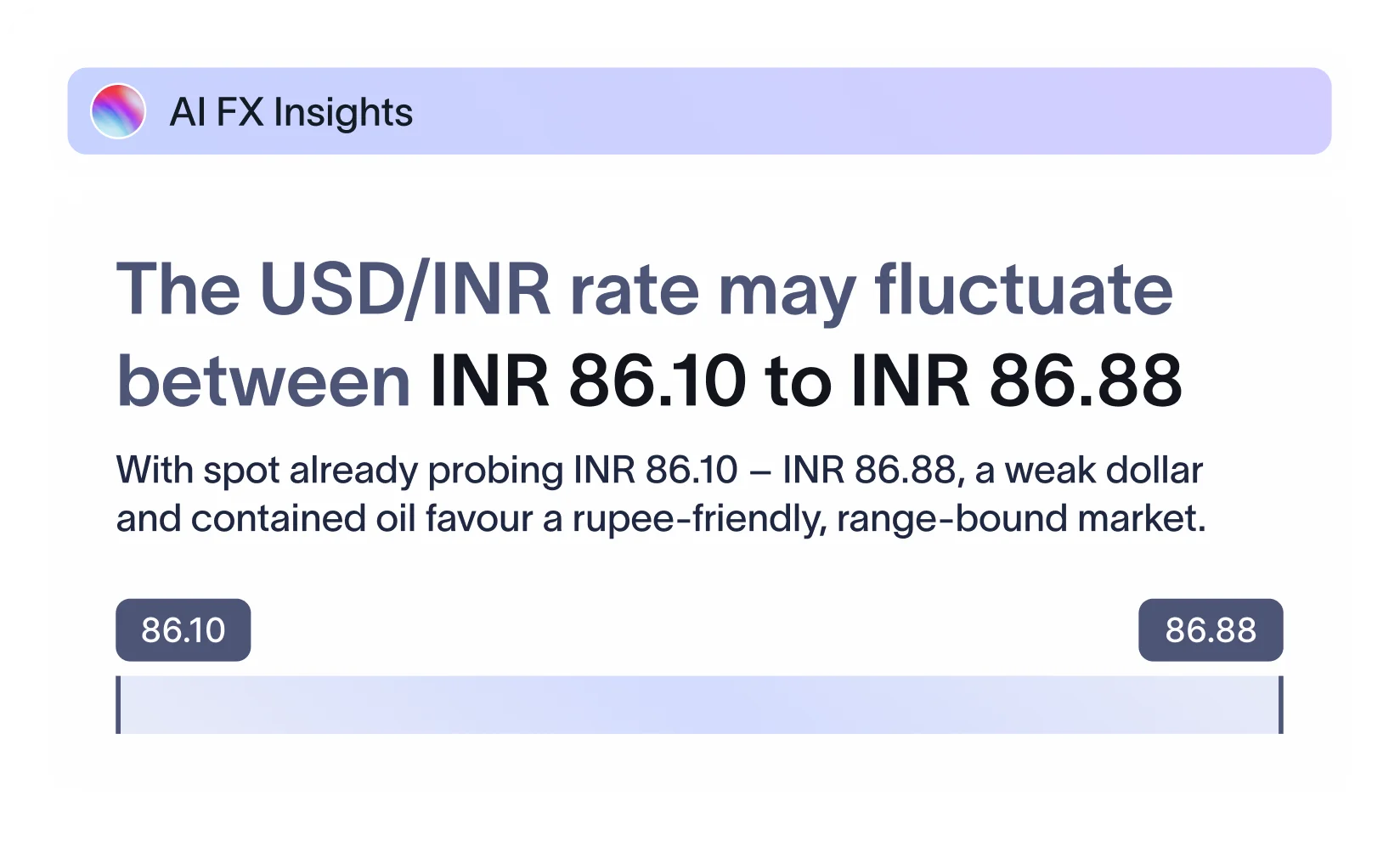

1. FX AI Analyst

Looks at market conditions and gives a 3-day FX outlook. This provides a prediction range for how the market is expected to behave over the upcoming 3 days.

2. Limit Order

Allows users to set a limit order based on their target FX rate. As soon as the rate is hit, funds are withdrawn at that rate.

Research Approach

This was our pilot. We couldn't rely on past transaction data to predict how users would adopt these new tools. But we knew their decisions hinged on three things: trust, savings, and data.

We crafted user stories that became our north star throughout the design process:

"I'm a user of Xflow Dashboard, I..."

'I want to see how the market is performing right now, what has the trend been like?'

'If I withdraw right now, how much INR would I receive?'

'What is the market outlook, how does it fare against the current rate?'

'Why should I trust your market sentiment analysis? How do I know of your track record?'

'How do I action on your analysis? How will this save me money?'

'Is my money safe if I set the limit order?'

Information Architecture

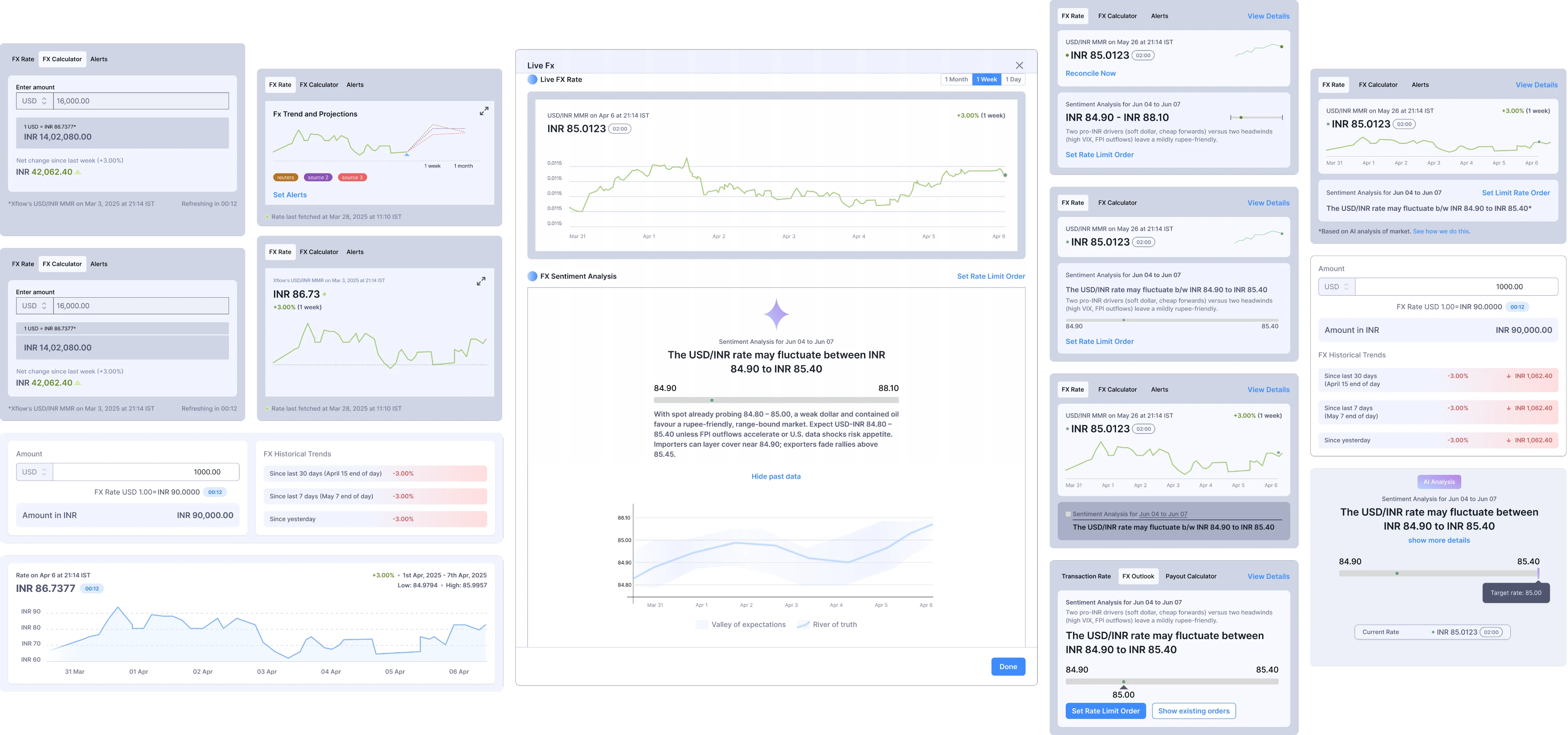

To satisfy all of the above user needs, we created four distinct yet interdependent information modules.

Current Trend

FX Outlook

Limit Order

Payout Calculator

Design Principles

Before diving into wireframes, we established three core principles:

1. Transparency over Persuasion — Show users the data; let them decide

2. Actionable Insights — Every piece of information should lead to a clear action

3. Build Trust Incrementally — Prove accuracy with track record, not just promises

Design Iterations

Iterating to find the right balance between current trend, future projections, and showing rates in MMR vs. transaction rate. The future projections also needed to integrate seamlessly with the limit order flow.

Wireframes

Market Trend and FX Outlook

Users needed to see the big picture at a glance. A homepage widget shows current market trends and a forecasted FX range, benchmarked against today's rate. The payout calculator answers the burning question: "If I convert now, how much INR do I get?"

Details of FX Market Trend

For users who want to dig deeper, we created a detailed view with historical trends, prediction justification, and our track record: building trust through transparency.

Setting a Limit Order

Setting a limit order means users trust us with their money over multiple days. We designed an experience that feels safe, transparent, and reversible at every step.

Reflection

What We LearnedDesigning for financial products is about managing anxiety as much as functionality. Users don't just need tools, they need reassurance. Showing our prediction track record and making every action reversible were as important as the AI itself.

Next StepsWe have had enough runtime with the product for use to have meaningful insights.

- We are now working on dedicated limit order listing and detail page.

- Do a visual revamp - the current graph on homepage shows range and not a trend. A trend says more than just a snapshot. We will combine the current graph with a trend graph to show the big picture.

- Show more consumable rationale for predictions.

What We AchievedWithin 6 months, businesses moved USD 4+ million using FX AI Analyst, saving over ₹10 lakh collectively. The product resonated so well that we're now expanding it with dedicated limit order pages and richer market data.

See more information about the product on xflowpay's website.